The American Family Act of 2023

BY ARIEL TAYLOR SMITH, SENIOR DIRECTOR OF THE NPU CENTER FOR POLICY AND ACTION

More than 200 members of the U.S. House of Representatives have thrown their support behind the American Family Act, new legislation that calls for the reinstatement of an expanded Child Tax Credit that would reduce child poverty in the United States by half. More than that, however, this legislation – introduced by Reps. Rosa DeLauro (D-CT), Suzan DelBene (D-WA) and Ritchie Torres (D-NY) – goes further than the temporary measures provided by Congress in 2021.

In 2021, Congress temporarily increased the amount of the Child Tax Credit from $2,000 to $3,600 for children under 6 years old, and to $3,000 for children over 6. This expanded credit resulted in the largest reduction of childhood poverty in U.S. history, and provided working families with the largest tax cut in generations. More than 61 million children were reached and, in 2021 alone, more than 4 million children were lifted out of poverty. Incomprehensibly, Congress chose to discontinue the expanded credit in December of 2021, plummeting American children back into poverty at an astonishing rate.

Research done by the Center on Poverty & Social Policy at Columbia University found that, between December 2021 and January 2022, child poverty rose a shocking 49% – from 12.1% to 17%. The American Family Act of 2023 gives Congress a chance to correct this mistake and helps set our children up for a future in which they thrive.

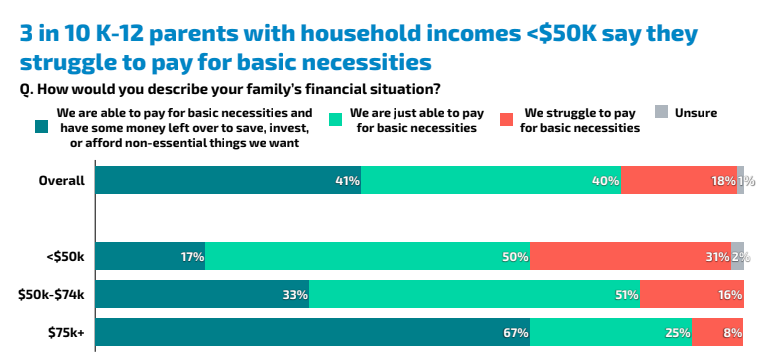

As the cost of housing and everyday goods continue to climb, American families are reaching their breaking point. The end of poverty reduction programs – such as the expanded Child Tax Credit and additional monthly SNAP benefit payments – are creating challenging situations for American families, and leaving them to make difficult decisions on how to make ends meet. A May 2023 poll conducted by the National Parents Union (NPU) found that a third of K-12 parents making less than $50,000 per year currently struggle to pay for their basic needs.

Under the current law, families can make too little to qualify for the Child Tax Credit. A family must have earnings of at least $2,500 to qualify. If their earnings are more than $2,500 but low enough that they do not have to pay Federal income taxes, they qualify for a reduced amount.

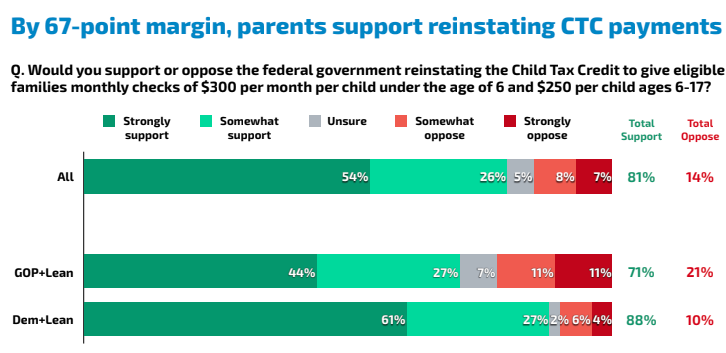

In our NPU poll, the Child Tax Credit expansion has strong bipartisan support- 88% of Democrats and 71% of Republicans.

The American Family Act would reinstate the expanded Child Tax Credit, and would permanently increase the credit from $2,000 to $3,600 for children under 6 years old, and to $3,000 for children from 6-17 years old. More than that, however, it would also:

- Expand to include children in U.S. Territories;

- Eliminate the earnings minimums that exclude one-third of children, providing everyone with the full credit in the form of monthly payments;

- Make the Child Tax Credit fully refundable;

- Guarantee that all children receive the same value of the credit in their first year of life, regardless of the month they are born.

Passing the American Family Act to ensure the expansion of the Child Tax Credit would be an investment in American families, and would show that leaders are committed to prioritizing the well-being of American families by creating a nation where all children thrive, including the most marginalized.

The National Parents Union strongly urges members of Congress to support this bipartisan effort to eradicate childhood poverty in the United States, ensuring that every family has the financial ability to raise the next generation of leaders, doctors, teachers and engineers for our communities.◼